Retirement income tax calculator 2021

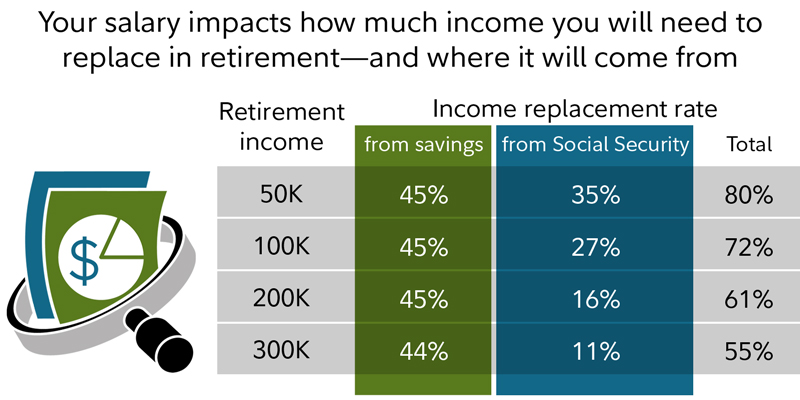

Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. Your household income location filing status and number of personal exemptions.

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

The 2021 deferral limit for 401 k plans was 19500 the 2022 limit is 20500.

. Enter your filing status income deductions and credits and we will estimate your total taxes. IR-2019-155 September 13 2019. You can use this calculator to help you see where you stand in relation to your retirement goal and map out.

The Income Tax Calculator estimates the refund or. The calculations use the 2022 FICA income limit of 147000 with an annual maximum Social Security benefit of 40140 3345. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. That would add up to taxes of 1200 on that retirement account. Your retirement is on the horizon but how far away.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov. Ad Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach.

Based on your projected tax withholding for the year we can also estimate. Our Resources Can Help You Decide Between Taxable Vs. General Pros and Cons of a 401 k Pros Tax-deferred growthSimilar to traditional IRAs or deferred annuities.

Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. Retirement tax calculator 2021 Jumat 09 September 2022 Edit. This means that you are taxed at 205 from.

Social Security Tax Changes for 2013 - 2022 High incomes will pay an extra 38 Net. In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100. For 2022 its 4194month for those who retire at age 70 up from 3895month in 2021.

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Office of Personnel Management. Automated Investing With Tax-Smart Withdrawals.

Figure your monthly Federal income tax withholding. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Between 25000 and 34000 you may have to pay income tax on. For instance a person who makes 50000 a year would put away anywhere. If thats less than your.

Ad Use our free retirement calculator and find out if you are prepared to retire comfortably. Free step-by-step webinar September 19. Ad Use our free retirement calculator and find out if you are prepared to retire comfortably.

This calculator provides only an estimate of your benefits. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. For example the total return including dividends of the SPTSX Composite Index for the 10 year period.

Multiply that by 12 to get 50328 in maximum annual benefits. The actual rate of return is largely dependent on the type of investments you select. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

In 60 seconds calculate your odds of running out of money in retirement. In 60 seconds calculate your odds of running out of money in retirement. We have the SARS tax rates tables.

Ad Its Time For A New Conversation About Your Retirement Priorities. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. In Just 3 Minutes Get Your Personalized Retirement Savings Action Plan.

Lets say your effective state tax rate in one of these states is 4 and your annual income from your 401k is 30000. Federal Employees Group Life Insurance FEGLI calculator. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Tax Withholding For Pensions And Social Security Sensible Money

Estimated Income Tax Payments For 2022 And 2023 Pay Online

What Will My Savings Cover In Retirement Fidelity

Tax Withholding For Pensions And Social Security Sensible Money

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

California Retirement Tax Friendliness Smartasset

Tax Calculator Estimate Your Income Tax For 2022 Free

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Social Security Benefits Tax Calculator

How Is Taxable Income Calculated How To Calculate Tax Liability

Federal Income Tax Calculator Atlantic Union Bank

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

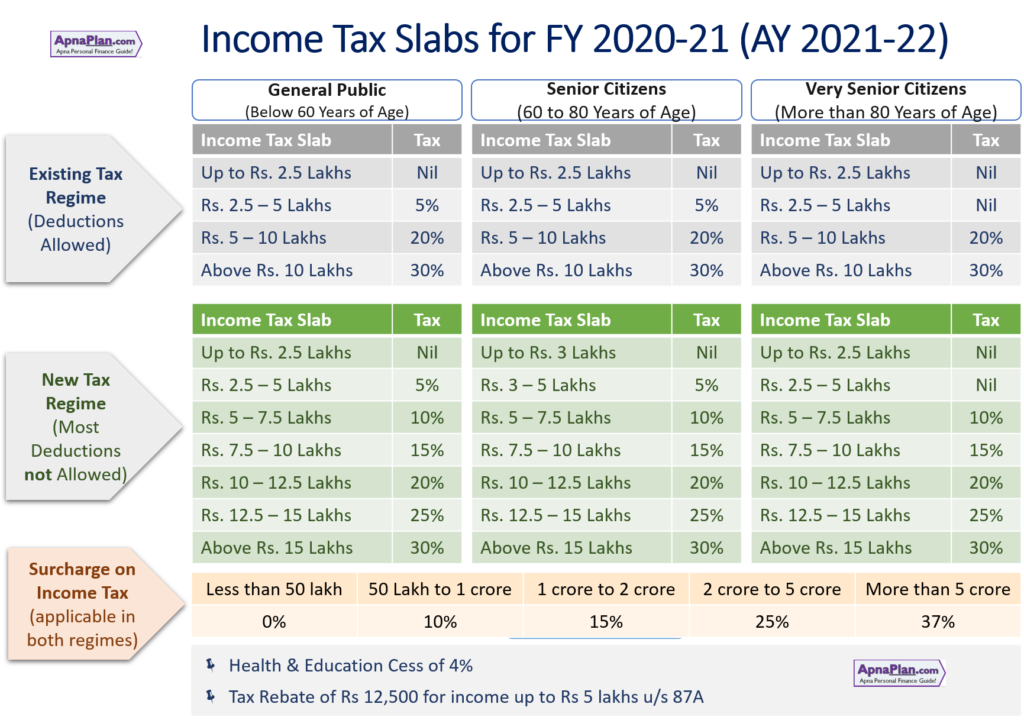

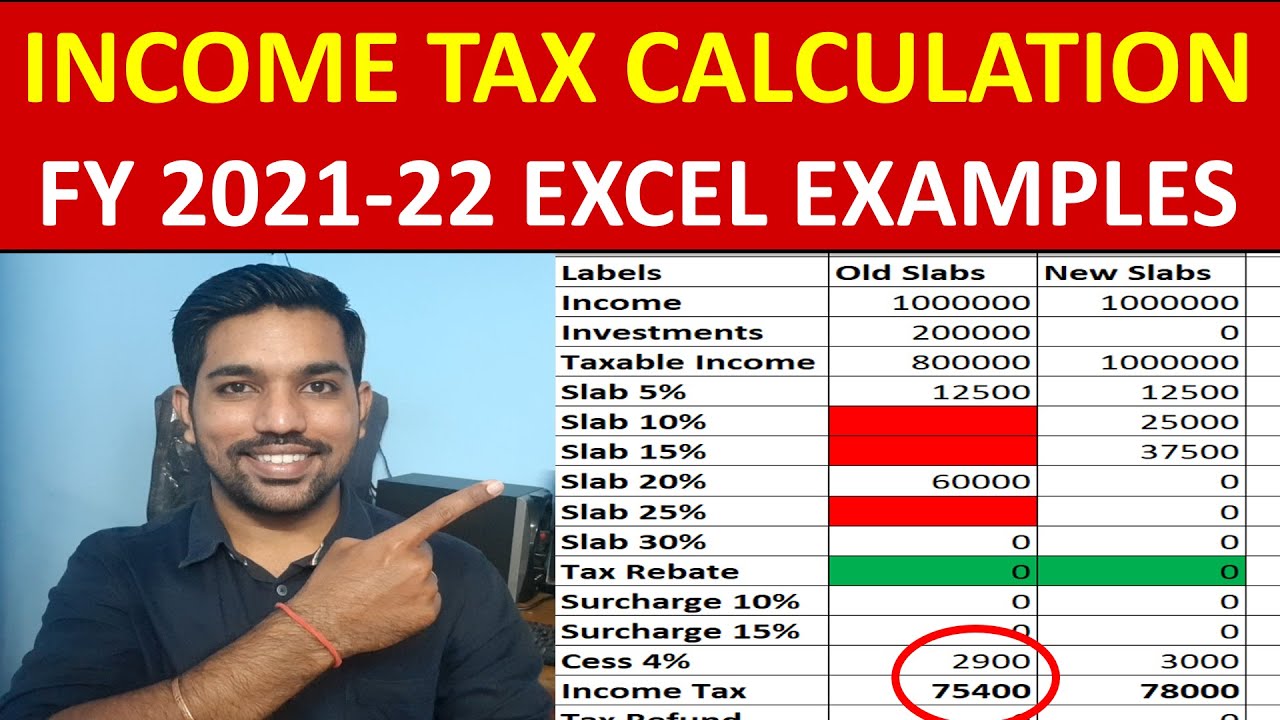

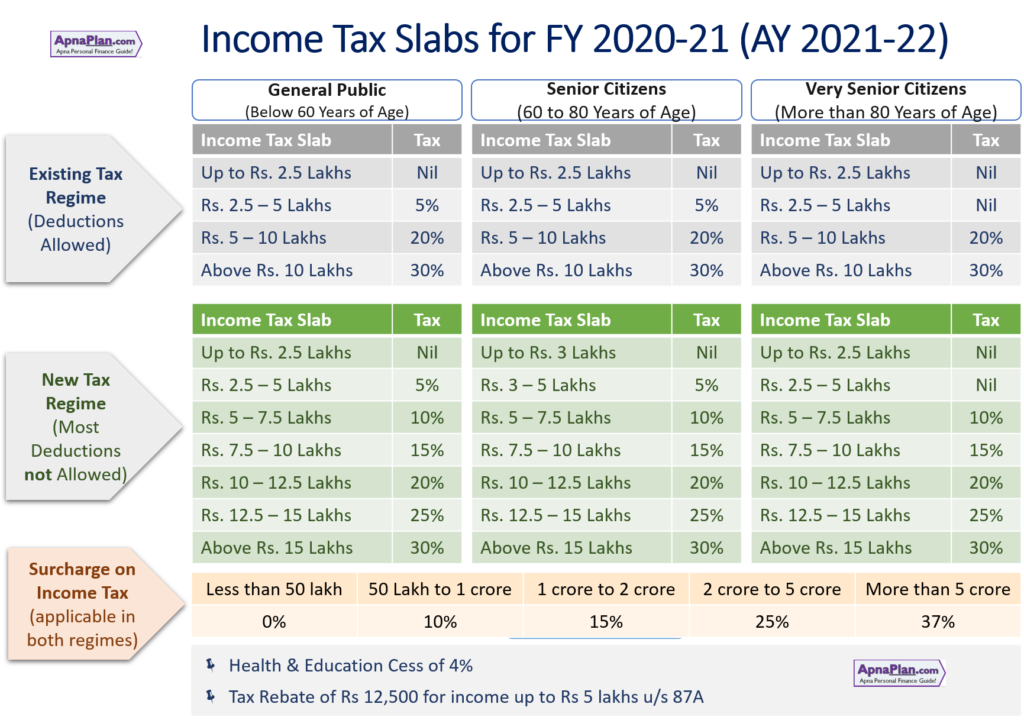

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas