Semimonthly payroll calculator

Withhold 62 of each employees taxable wages until they earn gross pay. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

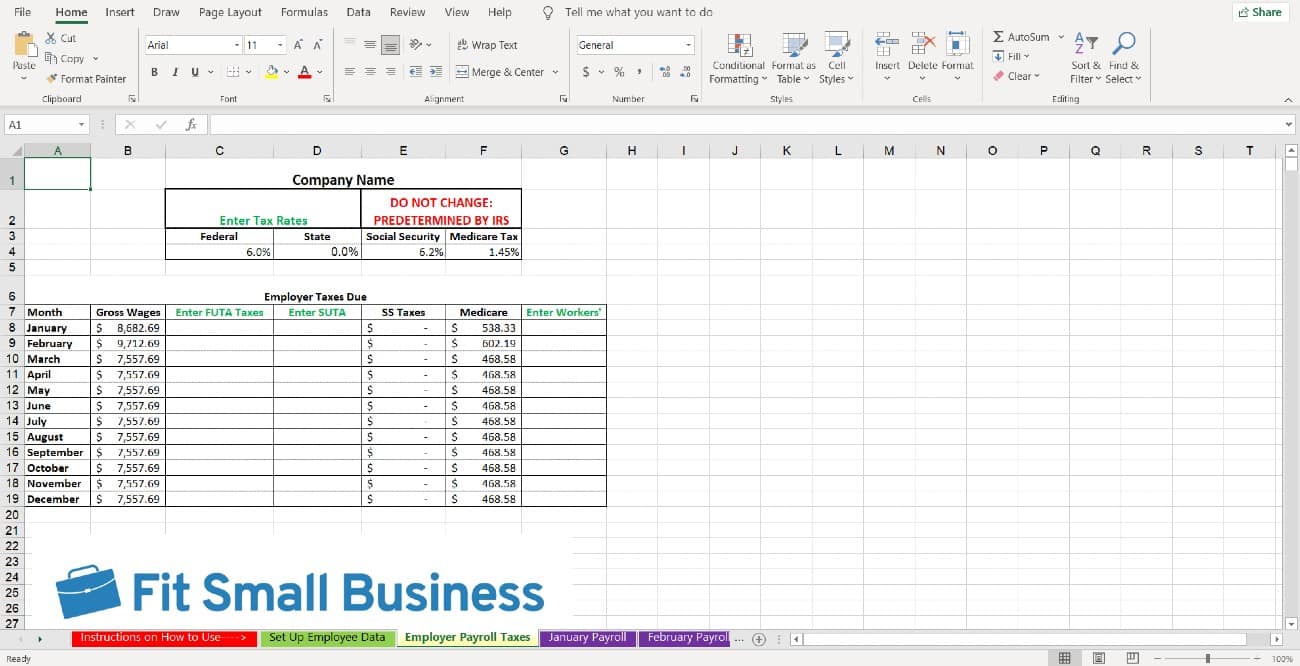

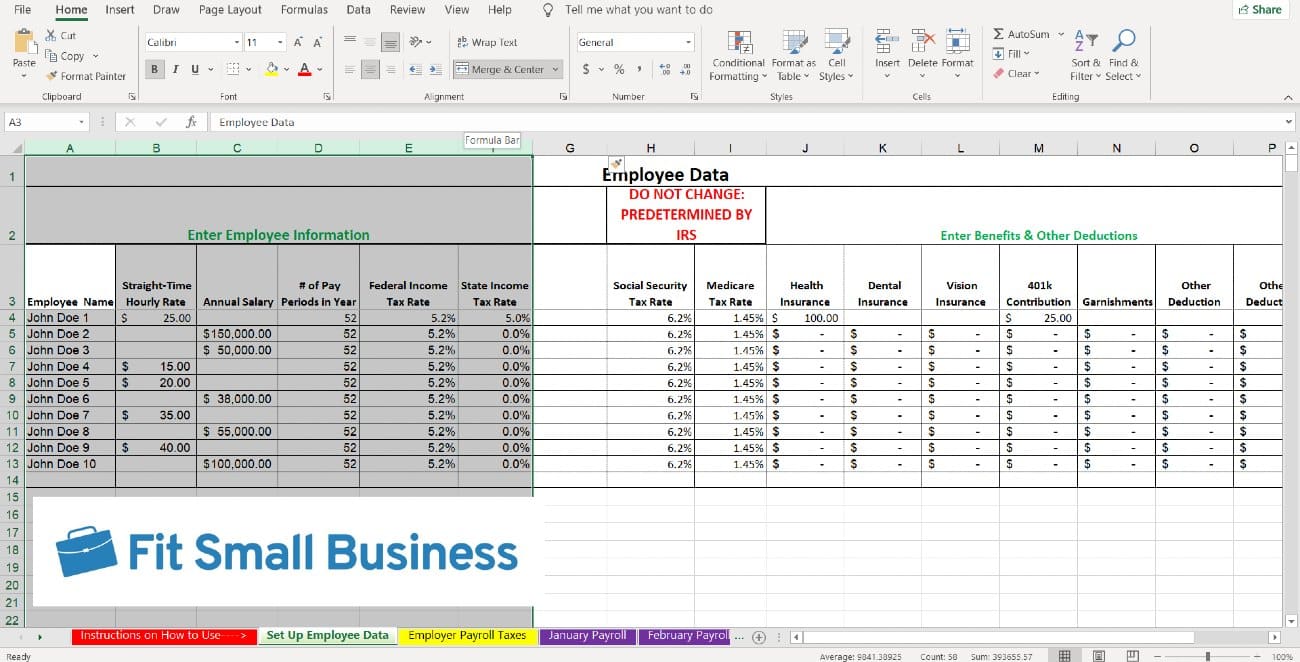

How To Do Payroll In Excel In 7 Steps Free Template

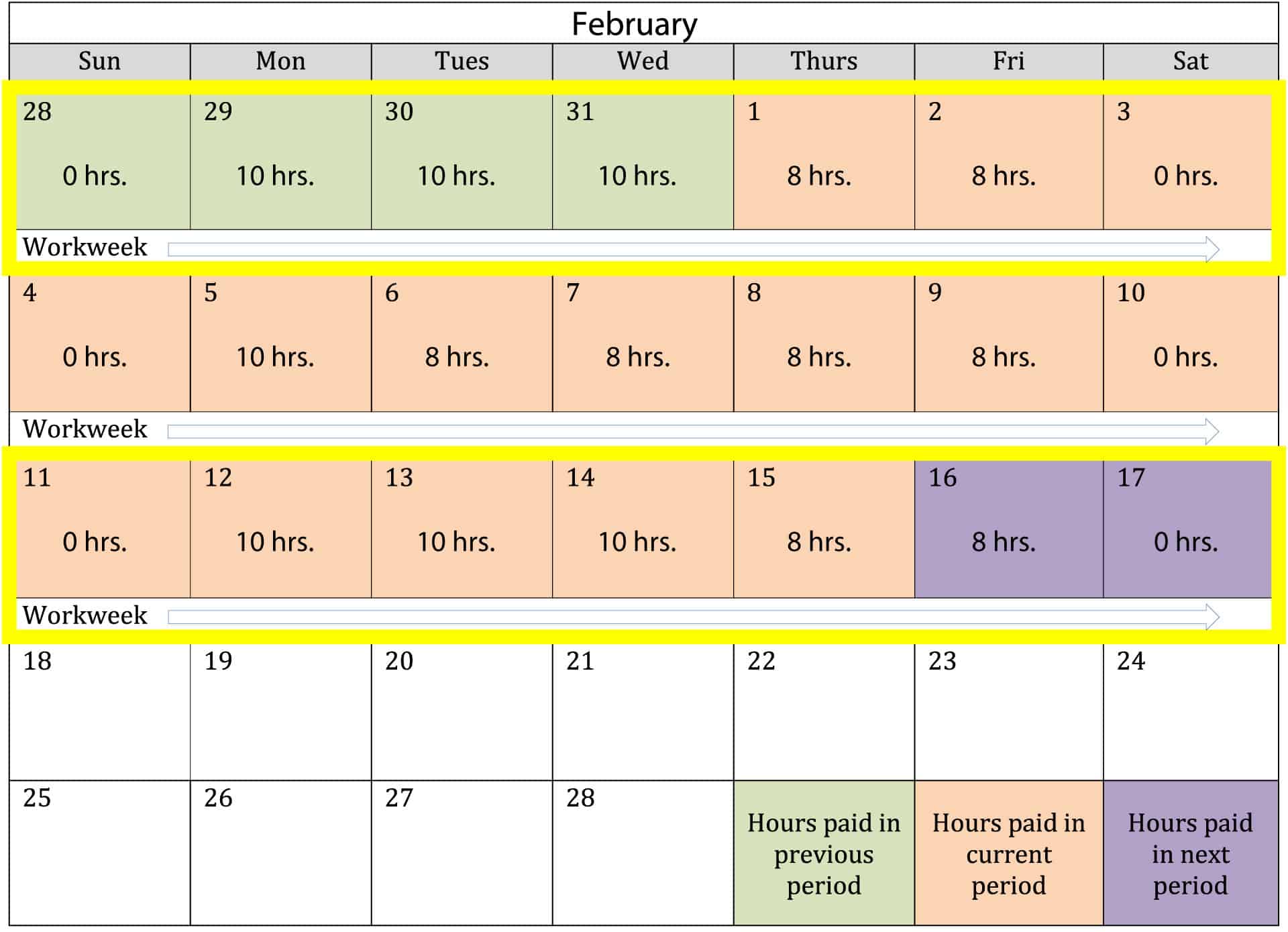

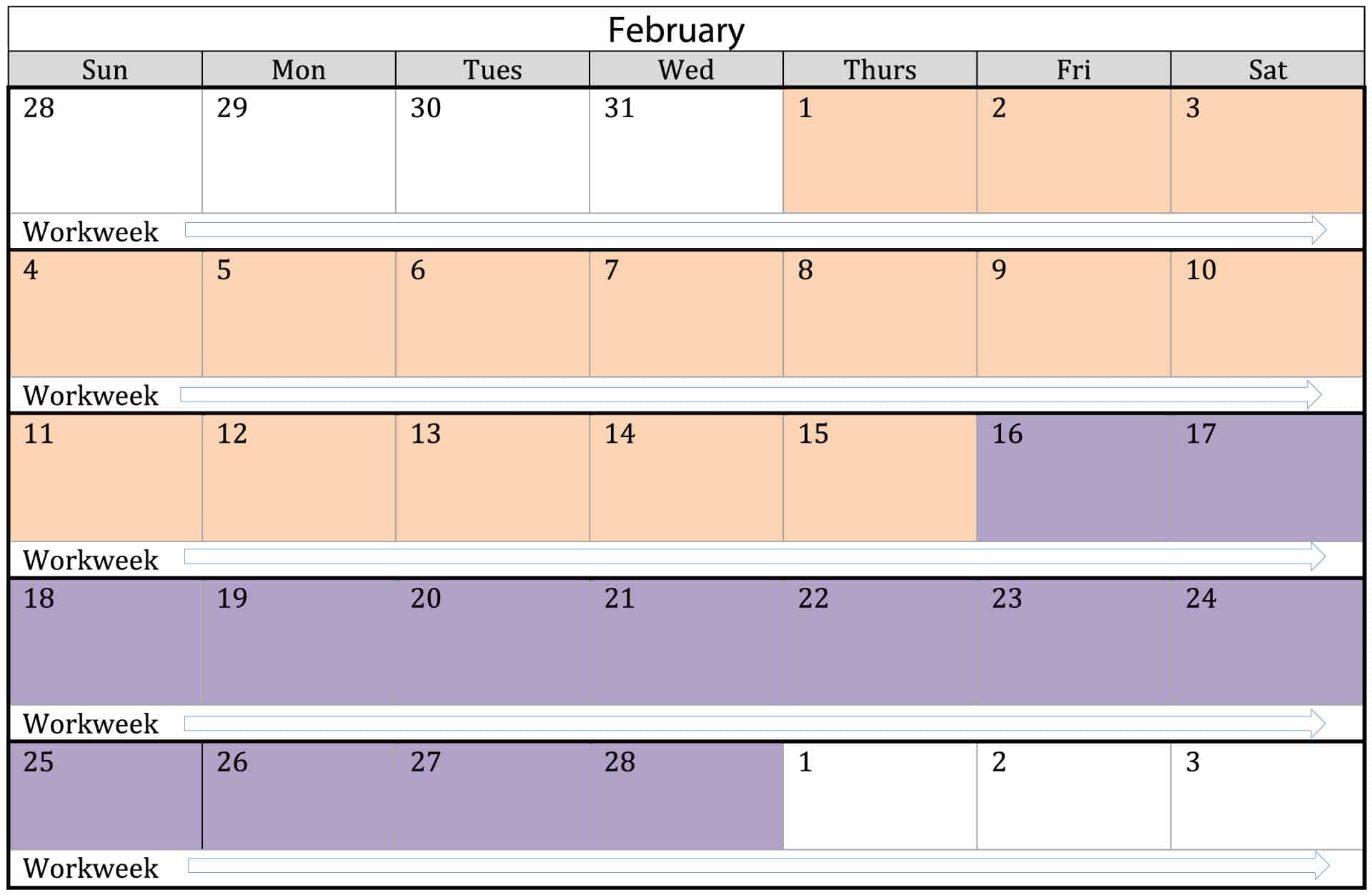

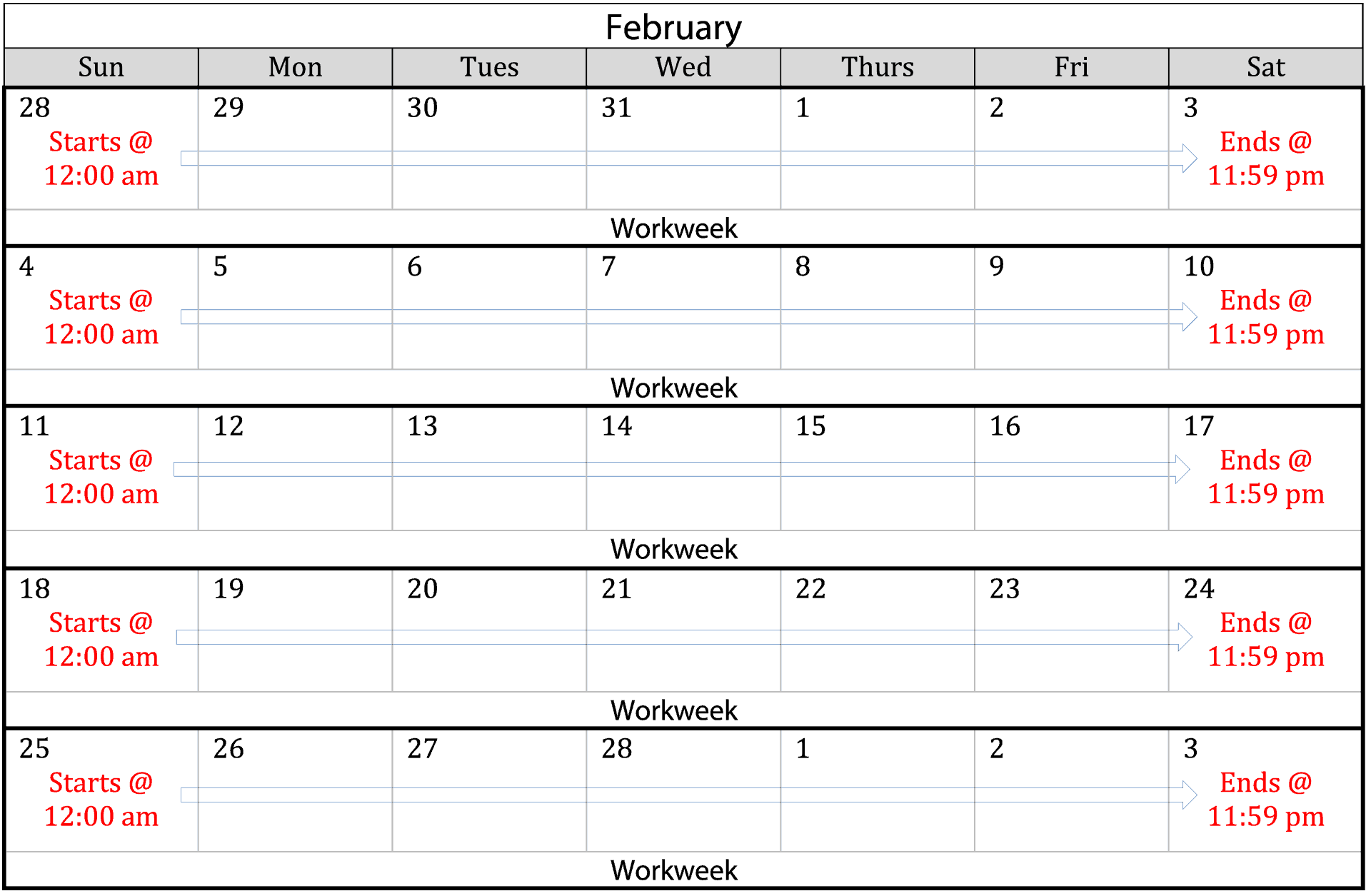

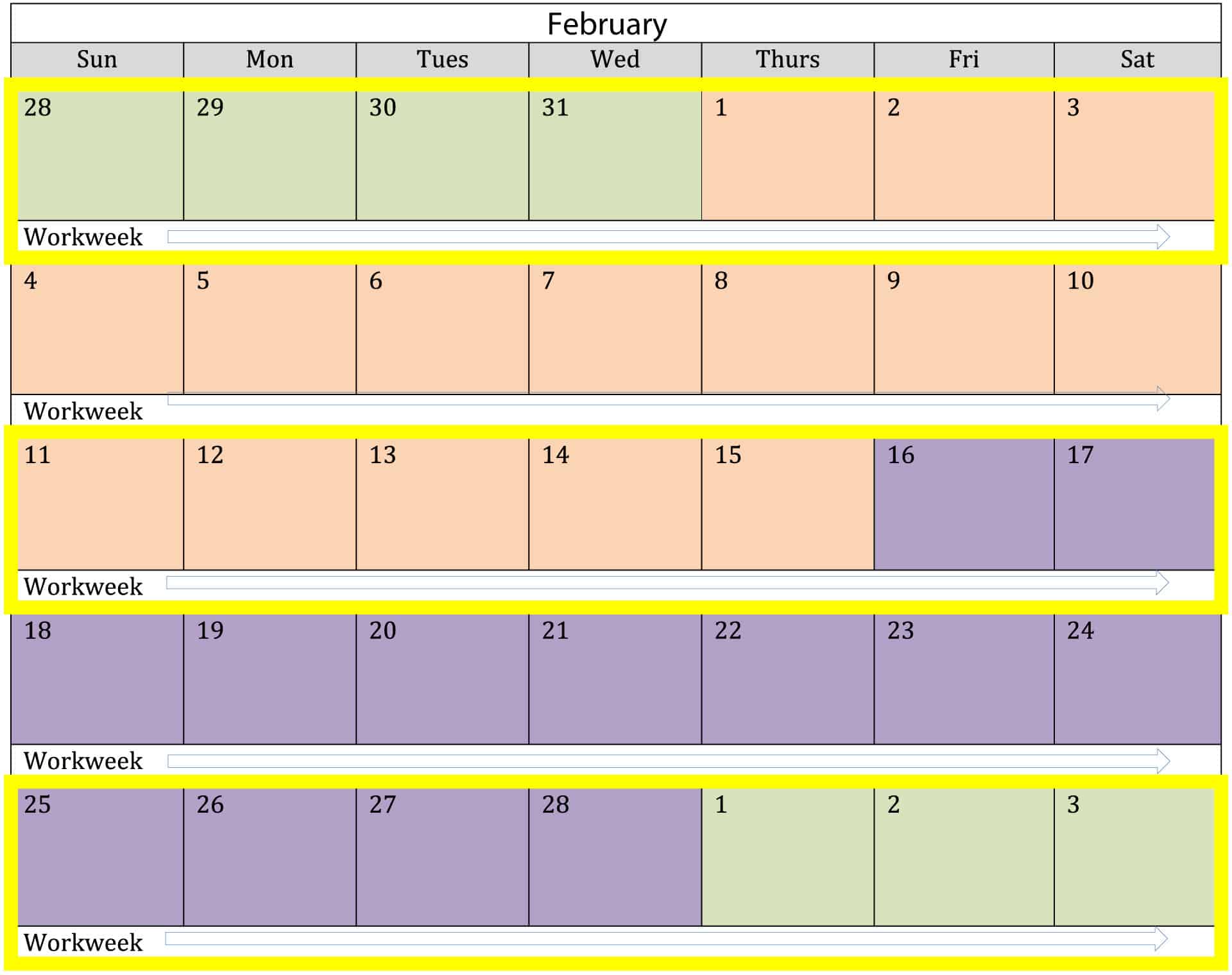

To calculate the number of overtime hours worked add the number of hours worked in the second workweek of the pay period and deduct 40 from the.

. Learn More About Our Payroll Options. Discover ADP Payroll Benefits Insurance Time Talent HR More. Multiply gross pay for one bi-weekly pay period by 26 to get the annual salary.

Pay Period Beginning Date. Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

Divide the annual salary by 24 to get the gross pay for one semi-monthly period. Free Unbiased Reviews Top Picks. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Overtime is calculated based on a workweek which is a 7-day period established by your employer. Compare the Best Now.

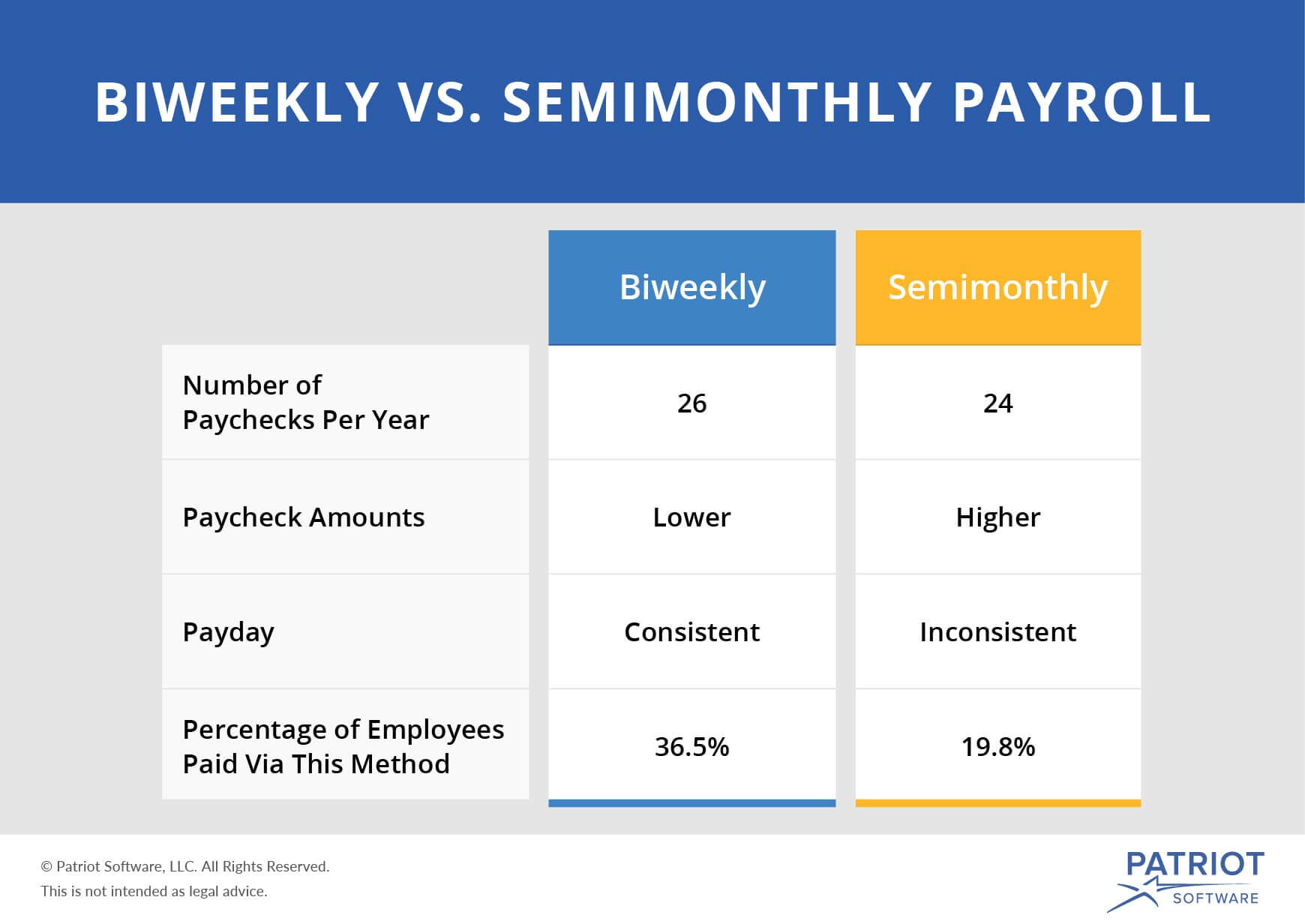

For the cashier in our example at the hourly wage. Semimonthly payroll produces 24 consistent paychecks per year. However semi-monthly pay periods can be confusing when determining.

These items must be received by the payroll office on or before the due date indicated above in order to be paid on the designated pay date. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. A semi-monthly payroll has 24 pay periods in the year.

Salaries are divided into 24 pay. Anything received after the due. The calendar year has 2080 hours 40 hours x 52 weeks which includes paid time off such as vacation and holidays.

Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. Pay Period Ending Date. On a biweekly schedule the employees gross pay per paycheck would be.

Ad Compare This Years Top 5 Free Payroll Software. Federal Salary Paycheck Calculator. On a semimonthly schedule the employees gross pay per paycheck would be around 229167.

Due to the nature of hourly wages the amount paid is variable. Ad The New Year is the Best Time to Switch to a New Payroll Provider. Get Started With ADP Payroll.

Simplify Your Employee Reimbursement Processes. Ad Process Payroll Faster Easier With ADP Payroll. Ad See How MT Payroll Services Can Help Streamline And Grow Your Business.

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Dividing the total yearly salary by 12 will give you the gross pay for each month. The Addition of the Second Workweek. All other pay frequency inputs are assumed to.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Usually a monthly payment frequency is used for salary employees but hourly employees can be paid monthly as. Semimonthly payroll for salaried exempt employees is straightforward.

All semi-monthly paydays are the 5th working day after the end of the pay period. 1500 per hour x 40 600 x 52 31200 a year. Computes federal and state tax withholding for.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. All Services Backed by Tax Guarantee.

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Pros And Cons Biweekly Vs Semimonthly Payroll

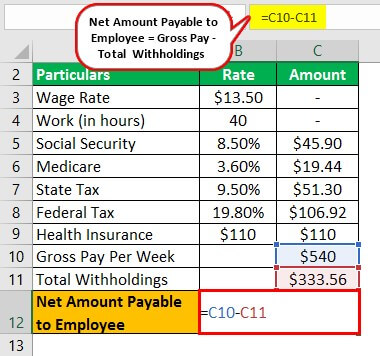

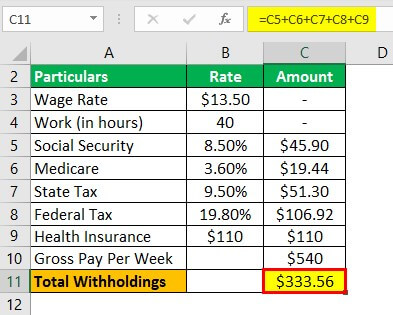

Payroll Formula Step By Step Calculation With Examples

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

How To Do Payroll In Excel In 7 Steps Free Template

Elaws Flsa Overtime Calculator Advisor

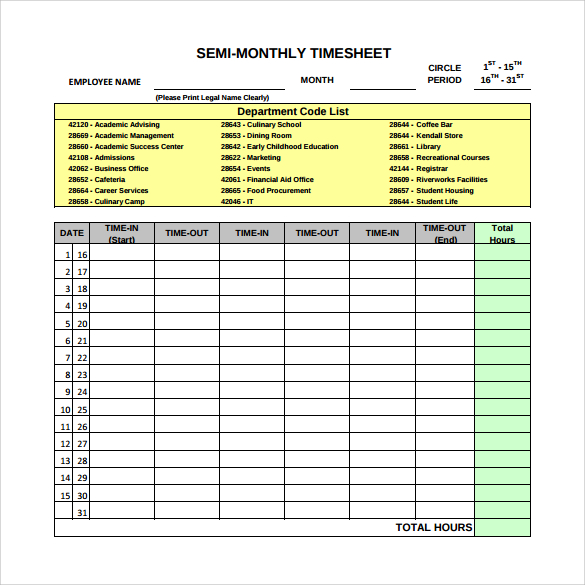

Free 10 Monthly Timesheet Calculators In Google Docs Pages Ms Word Pdf

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Payroll Formula Step By Step Calculation With Examples

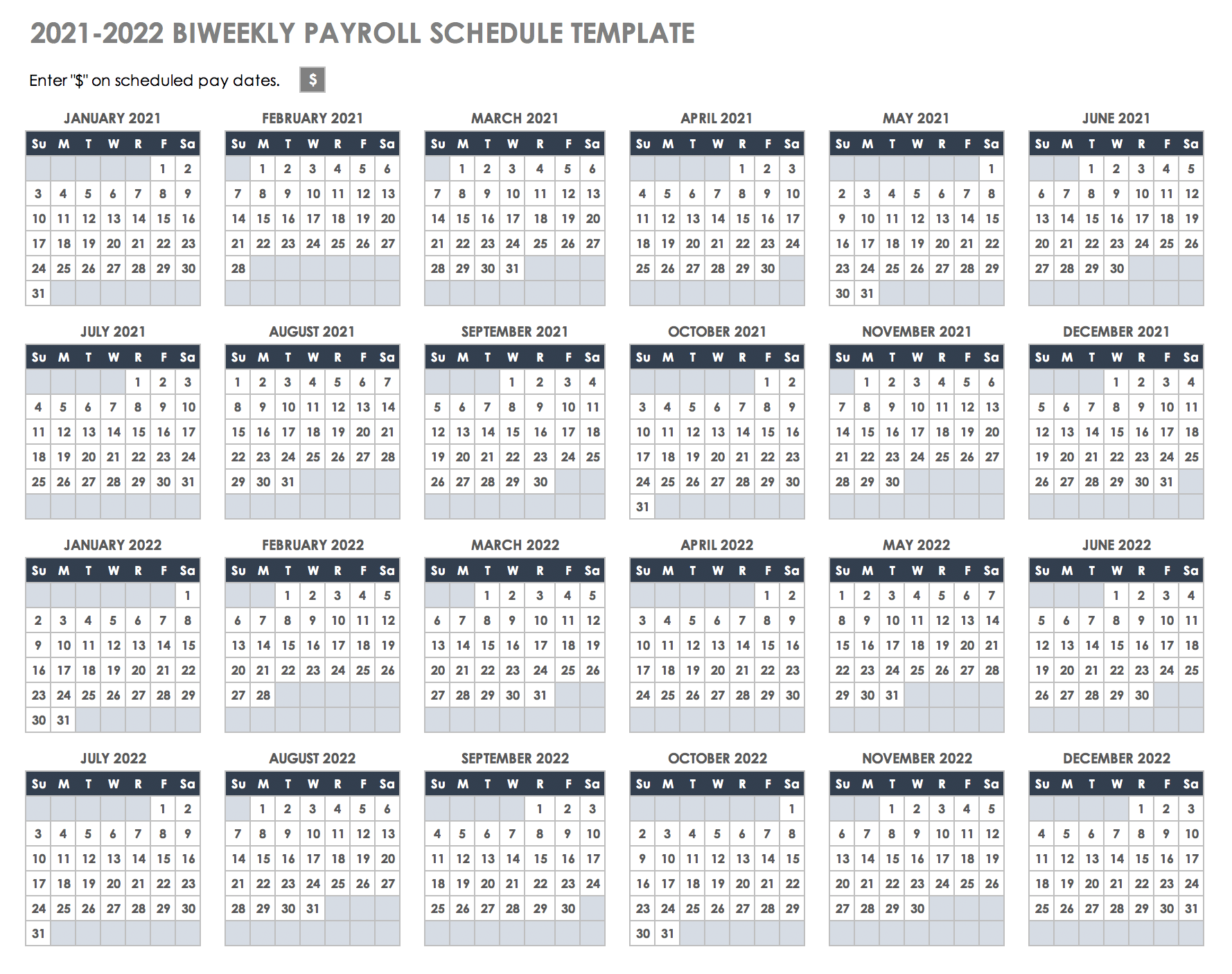

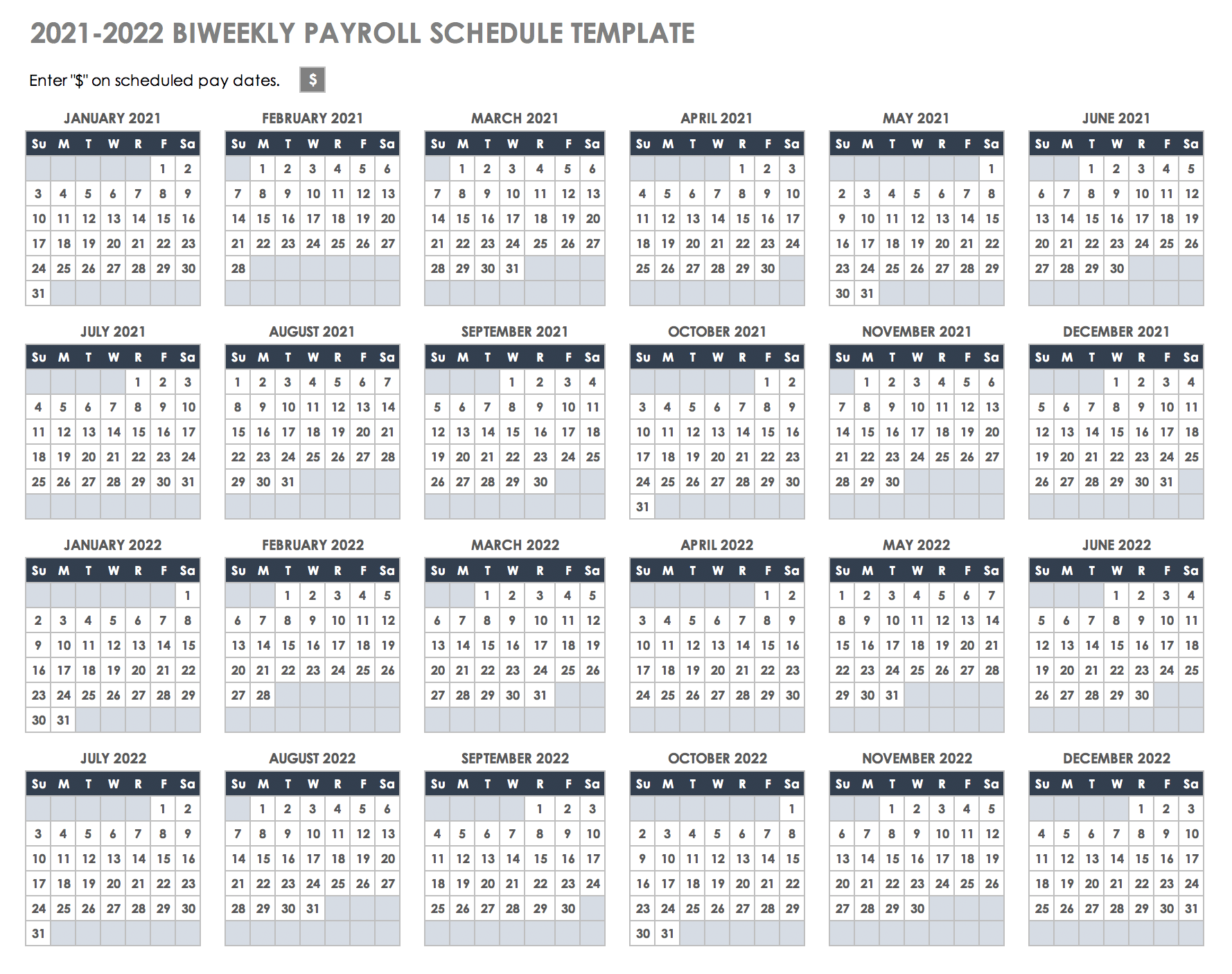

15 Free Payroll Templates Smartsheet

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Semi Monthly Timesheet Calculator With Overtime Calculations

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

How To Calculate Retroactive Pay Payroll Management Inc